A collection of projects focused on statistical analysis.

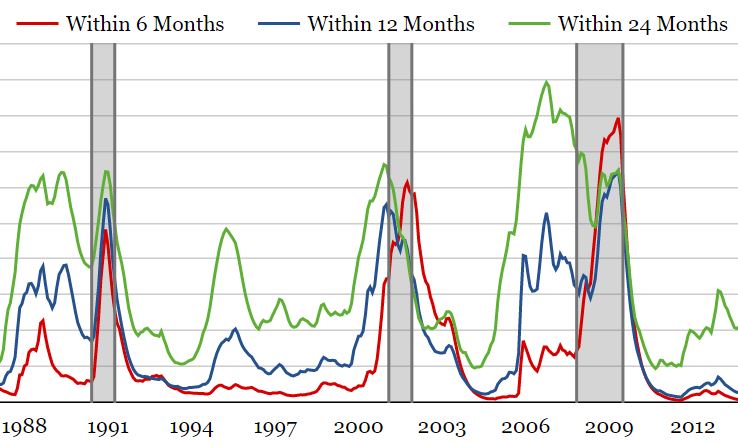

Recession Predictor

This project presents a machine learning approach for predicting U.S. recession occurrence for 6-month, 12-month, and 24-month time frames. The predictive model uses a handful of employment, inflation, interest rate, and market indicators.

Financial Turbulence and Systemic Risk

This project illustrates 2 unique approaches for monitoring financial risk, and shows how they can protect investors during future financial crises.

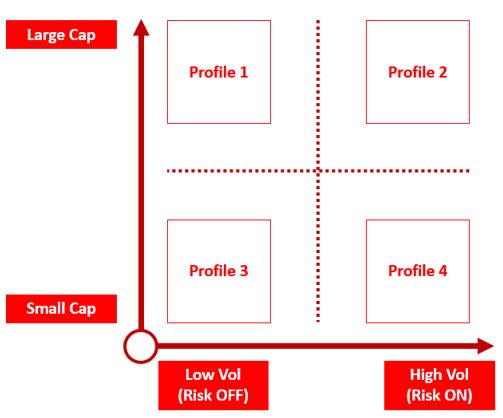

A Machine Learning Investing Tool

As more people apply machine learning to investing, one unique approach may hold promise: Factor Investing, using Classification Algorithms.

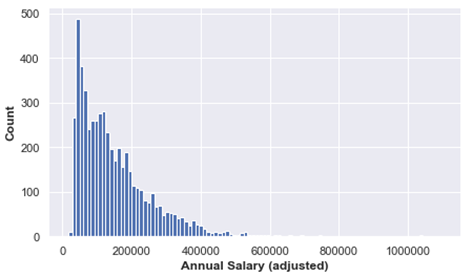

Does an academic “Gender Wage Gap” exist at the University of Florida?

After analyzing over 5,000 individual salaries at the University of Florida, the ANOVA model suggested that Gender alone is an insignificant predictor of salary amount. However, within every academic job level, males seem to be paid significantly more than females. What could be causing this?

Machine Learning and Earnings Surprises

Is it possible to predict stock price movements around earnings announcements, using features derived from Credit Default Swaps (CDS) and the stocks and options markets?