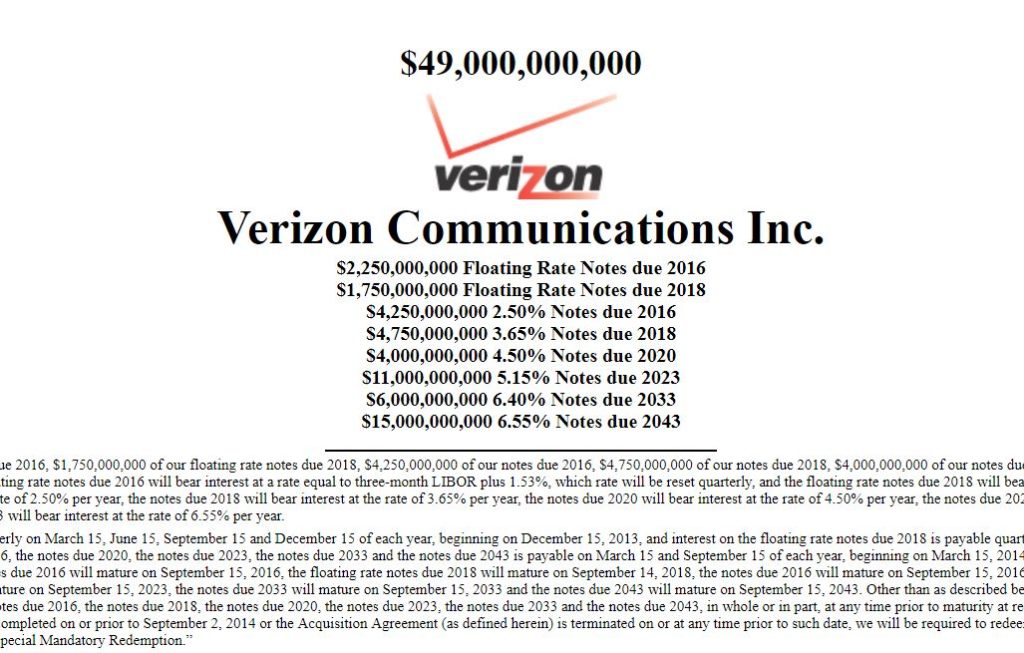

When corporations issue public bonds, they create prospectuses (like the one pictured above) that describe the structure of the new bonds, and publish those prospectuses in the Security Exchange Commission’s EDGAR database.

I have written a Python script to scrape EDGAR and comb through these prospectus filings to create a database for new bond issues.

- Note: as of June 2019, I am no longer maintaining this project and updating the database.

- BondDatabase Excel file (updated June 1, 2019)

- BondDatabase SQLite file (updated June 1, 2019)

- GitHub repository is currently private, since I am no longer maintaining this project.

Facts about the database:

- Contains around 4000 bond and preferred stock issuances for approximately 700 unique issuing entities.

- Bond issuances are classified as one of “Notes”, “Subordinated Notes”, “Mortgage Bonds”, “Contingent Capital”, “Capital Securities”, “Equity Units”, “Corporate HiMEDS Units”, or “Equipment Notes”.

- Preferred stock issuances are classified according to their convertibility (Mandatory Convertible or not), dividend policy (Cumulative or not), and maturity (Perpetual or not).

- Does not include asset-backed notes, equity-linked notes, or notes issued as part of an exchange offer.

- Focuses on USD denominated issuances.

- Only includes issuances after January 1, 2004.

At present, underwriters and issuers active in the US corporate bond markets are not obligated to share new issue reference data with a central depository (source). Therefore, existing bond issuance databases, while more comprehensive than this one, are hidden behind substantial pay walls:

— Bloomberg Terminal ($25,000 per year)

— FactEntry ($7,200 per year)

— Wharton Research Data Services

Attribute Descriptions

IssueDate – Date on which the final issuance prospectus is filed with the SEC.

IssueType – The issuance type.

IssueSize – The size of the issuance, aggregated across all tranches of the issuance.

TrancheCount – The number of tranches in the issuance.

Ticker – The ticker symbol of the issuer’s publicly-traded parent entity.

Name – The name of the issuer.

Sector – The issuer’s GICS Sector classification.

Industry – The issuer’s GICS Industry Group Name.

Country – The issuer’s country of domicile.

CIK – The issuer’s SEC Central Index Key.

10-K Check – If the issuer has filed a 10-K annual report within the last 1.5 years, then it passes the check. Otherwise, it fails the check.

Disclaimer:

This database is not exhaustive at the aggregate level, however, it tries

to be exhaustive for the companies covered by the database.

In other words, don’t use the database to calculate aggregate market statistics such as:

— How many bonds were issued in the US in 2017?

— How many companies issued bonds in the US in 2017?

Instead, use this database to answer company-specific questions such as:

— How many bonds did Apple Inc. issue in 2017?

— What types of bonds did Apple Inc. issue in 2017?